Demystifying the complexity of sending international wires through SWIFT

TL;DR: Key takeaways on SWIFT international wires

- Transfers take time. International wires typically take 1–5 business days, depending on currency, corridor, and intermediary banks.

- Fees can add up. Even if your bank advertises “free” wires, intermediary and recipient banks may deduct their own fees.

- Not all corridors are equal. Payments to major markets (e.g., UK, EU) usually clear faster than transfers to emerging markets, where extra checks or correspondent banks are involved.

- Transparency matters. Knowing what information to include (e.g., recipient bank codes, IBAN/SWIFT numbers) reduces delays and failed payments.

Alternatives exist. Local rails like SEPA (EU) or FPS (UK) often process faster and cheaper than SWIFT, but only work within those regions.

It’s confusing when you send what you thought was a “free” international wire, only for your recipient to be charged an unexpected fee.

Traditional banks love to talk about how easy and convenient it is to send money overseas. And in some ways, they’re right. Thanks to the SWIFT network, you can move funds around the world quickly — sometimes in a matter of hours.

But there’s a catch: even when your bank advertises free wires and the absence of hidden fees, your recipient may end up with less money than expected because a middleman — a bank you perhaps didn't know would be involved in the transaction — levied a fee.

In this article, we’ll break down the complicated and opaque process of sending and receiving international wires via SWIFT so that you can be prepared to expect the unexpected when it comes to fees.

What are SWIFT payments?

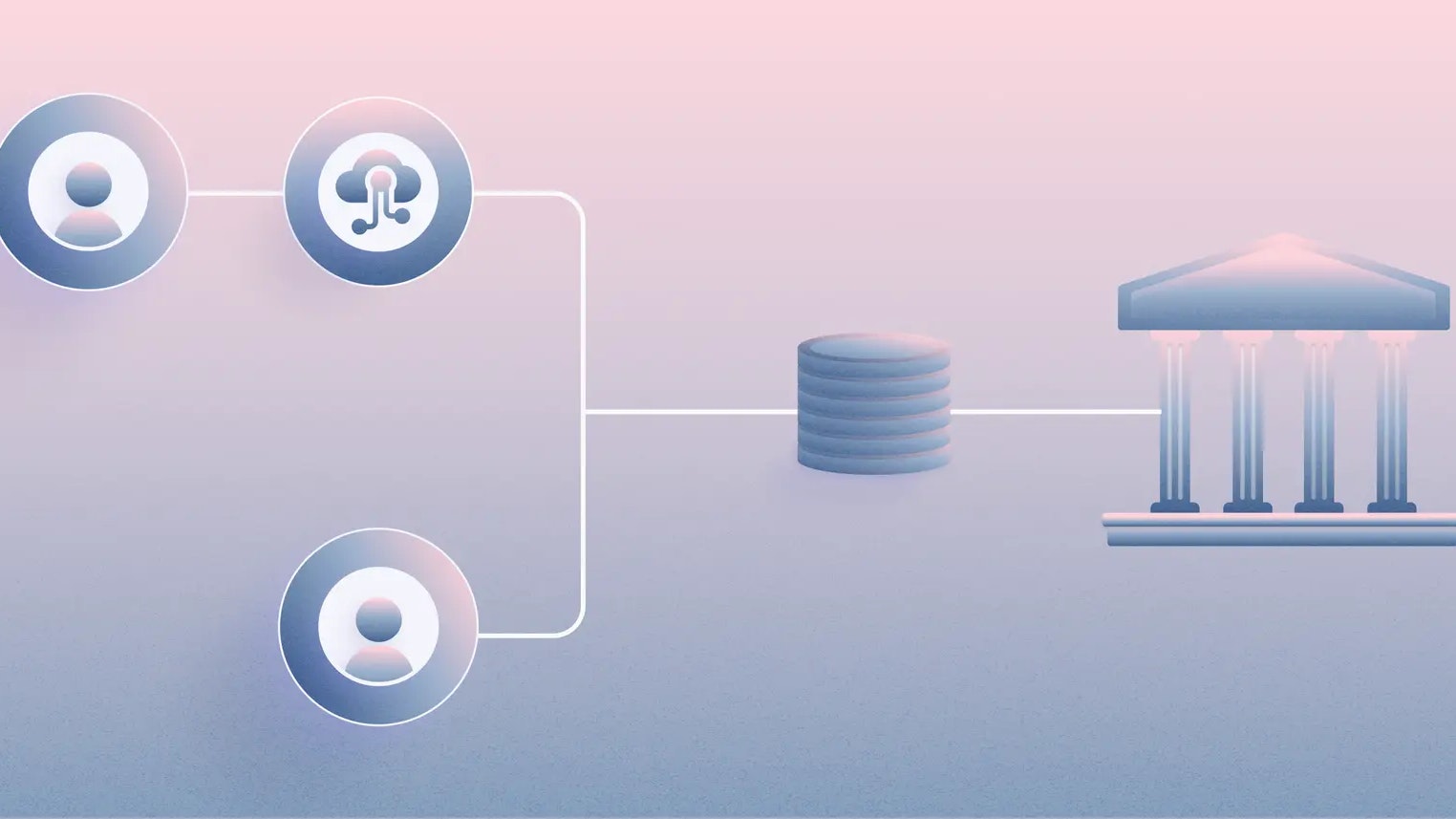

The SWIFT (Society for Worldwide Interbank Financial Telecommunications) network is a messaging system that financial institutions use to securely send and receive information about financial transactions. A SWIFT payment — sometimes called a SWIFT transfer — is a money transfer initiated through the SWIFT network.

When you send a SWIFT payment, your bank will use the SWIFT code of your recipient’s bank to route the money to the right place. The recipient’s bank will then credit the funds to their account.

In most cases, a SWIFT payment will go through without any problems. But because the SWIFT network consists of thousands of banks in more than 200 countries and territories, it’s not unheard of to deal with unexpected delays or, in some cases, fees.

How do SWIFT payments work?

When sending a SWIFT payment, there are a few pieces of information you’ll need to provide your bank, including:

- The name and address of the recipient’s bank

- The recipient’s SWIFT code

- The recipient’s account number or IBAN (International Bank Account Number)

- The amount of money you want to send

- The currency you want to send it in

- The reason for the payment (e.g., “Invoice Payment”)

Once you have all the necessary information, you can initiate the payment through your online banking portal or by visiting your local branch.

It’s important to note that SWIFT payments are not the same as domestic wire transfers. With a domestic wire transfer, money is transferred directly from your bank account to the recipient’s bank account. A SWIFT payment, however, may have to pass through multiple banks — called “intermediaries” — before the money reaches its final destination.

Usually, banks will have credit or debit accounts with one another and use them to fund interbank transfers. However, if your bank doesn’t have a direct commercial relationship with the destination bank, the payment must be routed through an intermediary bank — or multiple intermediary banks. And each time that happens, you may be charged a fee.

Here’s an example: Let’s say you want to send a SWIFT payment from Wells Fargo (U.S.) to Westpac (Australia). If Wells Fargo and Westpac do not have a direct relationship, the payment will be routed through an intermediary bank — in this case, the Hongkong and Shanghai Banking Corporation (HSBC) in Hong Kong.

The payment will first be transferred from Wells Fargo to HSBC, and then it will be transferred from HSBC to Westpac. And each time the money is transferred, a fee might be levied on the payment.

Let’s also consider a scenario where there are multiple intermediary banks involved. If Wells Fargo and Westpac do not have a direct relationship, nor do they both have direct relationships with HSBC, another intermediary bank will get involved. Wells Fargo will first transfer the money to HSBC. Then HSBC will transfer the money to another intermediary bank – let’s say Deutsche Bank in Frankfurt. Finally, Deutsche Bank will transfer the money to Westpac. In this scenario, the sender bank, the two intermediary banks, as well as the recipient bank could all levy a fee on the payment as the money passes through the chain of connections.

As a result of this complicated process, SWIFT payments can take longer to process than domestic wire transfers, often taking about 3–9 working days.

How are SWIFT payment fees levied?

In general, there are three ways that banks can levy fees for SWIFT payments:

- The sender’s bank can charge a fee to send the payment.

- The intermediary bank can charge a fee to process the payment.

- The recipient’s bank can charge a fee to receive the payment.

Depending on the banks involved and the amount of money being transferred, you may be charged one or more of these fees.

Whether you or the recipient pays the fees will depend on your bank’s policies and the terms of your payment agreement. You may never see these terms being referenced directly by your bank, but this is happening under the hood of any SWIFT payment.

When the payment is initiated, the sender bank will use any of the following commands to indicate the fee structure:

- OUR: the sender pays all the fees, and the recipient receives the full amount without deductions.

- SHA: the sender pays all the fees charged by the sending bank, and the recipient’s bank deducts their fee from the amount to be received. This way, both parties share the cost of the transaction.

- BEN: the recipient pays all the SWIFT fees (sending, intermediary, and receiving bank charges), and the sender incurs no transaction costs.

One of the biggest challenges with SWIFT payments is the lack of transparency. When you send a payment, you typically don’t know which intermediary banks will be involved or how much they’ll charge in fees. And even if your bank is able to negotiate lower rates with its intermediaries, you may not know about it unless you ask.

This lack of transparency makes it difficult for even banks with the best intentions to improve their user experience. As a result, customers often feel frustrated and dissatisfied with the SWIFT payment process.

Can SWIFT payment fees be avoided?

While banks may negotiate lower rates with their intermediaries to avoid hefty fees, the only way to truly reduce or avoid SWIFT payment fees is to not send money via SWIFT in the first place. Fortunately, there are some other options.

If you are sending funds in the recipient’s local currency, a rising trend is to circumvent SWIFT through local payment rails. For example, if you’re sending euros to Europe, the financial services provider may choose to route the payment through Single Euro Payments Area (SEPA). With SEPA, payments are direct bank transfers and are not sent through intermediary banks. This means the transfers are faster and intermediary bank fees are avoided. Similar local payment systems include Faster Payments Service (FPS) for British Pound Sterling (GBP) payments and Electronic Funds Transfer for Canadian dollars (CAD). But note, not every bank or neobank will have the ability to send funds through these local routes, and you’ll need to look into the specifics around your bank or banking partner to see what your options are.

Imagine a startup wiring $100,000 to a supplier in Brazil. While Mercury charges no fee, two intermediary banks each deducted ~$25 for processing, and currency conversion shaved another 1%. The founder expected $100,000 to land, but only $98,950 arrived. Understanding these frictions up front helps teams budget accurately

SWIFT transfer speed compared to alternatives

Payment method | Typical speed | Best used for |

|---|---|---|

SWIFT transfers | 1–5 business days | Large, cross-border payments in major currencies; when reliability matters. |

ACH (domestic U.S.) | 1–3 business days | Low-cost domestic payments within the U.S. |

Wire (domestic U.S.) | Same-day (if sent early) | High-value, time-sensitive payments within the U.S. |

Real-time payments (RTP) | Instant (24/7) | Immediate domestic U.S. transfers, often capped at lower limits. |

Card networks | Seconds to minutes | Consumer payments and online transactions; higher fees for businesses. |

Takeaway:

SWIFT is reliable for large, international payments, but if speed, cost, or transparency matters, alternative rails can be faster and more predictable.

Where SWIFT transfers can be slower or more expensive

While SWIFT works globally, certain countries and corridors experience longer transfer times or higher fees due to banking infrastructure, regulatory requirements, or intermediary banks. Examples include:

Corridor | Typical SWIFT Transfer Time | Notes / Friction Points |

|---|---|---|

US → India | 2–5 business days | Multiple intermediary banks often required; fees can exceed $25 per transfer. |

EU → Nigeria | 3–6 business days | Limited direct banking connections; additional compliance checks may delay funds. |

US → Brazil | 3–5 business days | Currency conversion and intermediary banks add cost and complexity. |

EU → Argentina | 4–7 business days | Exchange control regulations can slow processing; some banks require manual intervention. |

US → emerging markets (general) | 3–7 business days | Intermediary banks, FX availability, and local banking holidays can cause delays. |

Why this happens:

Slower transfers usually aren’t caused by SWIFT itself but by factors like:

- Multiple intermediary/correspondent banks

- Currency conversions

- Regulatory or AML reviews

- Bank operating hours and cut-off times

Key takeaways:

Startups sending money to these corridors may benefit from fintech or local rails, which often reduce transfer times, lower fees, and provide more transparency.

At Mercury, we believe people should have more control over how their money is sent and greater visibility into the fees that might be levied.

For payments in currencies other than USD, our 1% foreign exchange fee covers both the cost to convert USD into 30 different currencies, as well as any intermediary bank fees.

For Euro payments in SEPA-enabled countries, we circumvent SWIFT by leveraging partner bank relationships to send all Euro payments through SEPA. We hope to expand local payment rails to other currencies in the future.

However, to send USD abroad, we still have to use SWIFT, and as you’ve just learned, SWIFT fees can be difficult to predict. While international wires are always free for Mercury customers to send, we cannot guarantee recipient or intermediary banks won’t levy a fee on the payment. To ensure that the full expected amount is always received, we offer customers the option to cover their recipients’ potential fees.

To learn more about how Mercury can help you confidently send international wires, explore our demo today.

FAQ: Common questions about international wires

Why was I charged a fee on a “free” wire?

Your bank may not charge an outbound fee, but intermediary or receiving banks often deduct fees before funds land. These can range from $10–$50+ per transfer.

How long does an international wire transfer take?

Typically 1–5 business days. Transfers between major currencies (USD ↔ EUR, USD ↔ GBP) are usually faster. Transfers involving emerging markets or exotic currencies often take longer due to additional compliance checks.

How can I avoid unexpected SWIFT fees?

Whenever possible, choose “shared fees” (SHA) or “ours” (OUR) when sending. Also, ask your recipient if they have a preferred correspondent bank to minimize unnecessary hops.

Do all countries support SWIFT transfers?

Nearly every major economy does, but efficiency varies. For example, wires to Western Europe often clear within 1–2 days, while payments to countries in Africa, Latin America, or parts of Asia may take longer.

Are there faster alternatives to SWIFT?

Yes. In the EU, SEPA transfers often settle same-day at low cost. In the UK, FPS clears near instantly. Within the US, ACH and FedNow can be cheaper for domestic payments. But for cross-border transfers outside these regions, SWIFT is usually the only option.